The Impact of COVID-19 on E-Commerce Sales in the UK

In January 2021, online sales in the UK had grown by 74% year-on-year. This is all following a consistent rise over the 12 months prior, most of which had been spent under COVID-19 restrictions. The latest figures show that during these months, Britons spent an astonishing £93 billion online.

But while these businesses might have been ahead of the curve at one point, the constantly changing digital landscape often opens up new opportunities. So, to help you, we’ve put together this detailed report which assesses the current COVID-striken e-commerce landscape across various industries, and outlines any potential opportunities or challenges that may lie ahead.

The e-commerce boom

Whether shopping for clothing, jewellery or a new home office set-up, online retailers have provided the only means for customers to get access to goods and services deemed non-essential. Of course, the move to categorise spending by the government was necessary to combat the spread of the virus, but the impact this has had on consumer perceptions and behaviours will last a long time.

Over a year after the early onset of the virus, e-commerce sales are at their highest, with no signs of slowing down. This is largely due to a combination of newly formed habits and a greater diversity in the options and offerings available online.

Consequently, more consumers have been turning to e-commerce websites than ever before. In fact, globally, new users are responsible for driving up to 50% of the increase in online shopping activity, including purchasing through an app, online grocery shopping, takeaway ordering and buying cosmetic and medicinal products.

Similarly, in the UK alone, 46% of consumers have purchased a product online during the pandemic that previously they had only ever bought in-store.

This is clear evidence that any previously held beliefs or concerns surrounding security, technical skills or accessibility have, for the most part, been minimised and consumers are now seeing the benefits of online shopping.

Ultimately, e-commerce is providing a way for businesses to meet the growing preference for on-demand services.

These changes in consumer behaviour and the undeniable market forces at work are transforming each and every industry. And here’s how…

Jewellery and watches

Jewellery stores have been presented with a unique set of challenges due to the pandemic. Up until recently, many retailers had placed a lot of focus on enhancing the in-store experience of their retail outlets and showrooms. Under pre-COVID circumstances, this worked well.

When buying an expensive item, a customer would have wanted to see the piece in person. In many cases, it wasn’t until they saw the item in real life that they decided to buy it. These types of purchases are driven by emotion and encouraged through the sensory experience of seeing, touching, feeling and trying on the piece of jewellery.

However, COVID-19 put a stop to this traditional means of selling jewellery and watches. While some businesses might have had websites, few were optimised for the modern day digital savvy consumer.

Alongside this challenge, there was another involving the changing lifestyle and attitudes of consumers. With jewellery and watches deemed non-essential, and stay at home orders limiting the need and desire for such items, purchasing motivation had also taken a hit, which is reflected in the plummeting sales figures during the UK’s national lockdowns (March and November).

The drop in sales, however, was temporary and sales did bounce back. The increase was in line with the reopening of retail shops and at the same time more businesses started selling their jewellery online.

Going forward, online sales will help jewellery stores maximise sales and revenue.

Although physical stores will reopen, jewellers will need to continue supporting online shopping and also provide an omnichannel presence that is consistent and complementary for those who want to shop both online and instore.

Digital services such as click and collect, online financing or buy now pay later offers, appointment booking forms and virtual consultations have all helped jewellers survive the pandemic. Looking to the future, these will help jewellers combine and supplement their store offerings and reach a wider audience across the country.

However, going from focusing on just one sales channel to several can create more challenges, such as increased workloads and stock management issues, which may increase the likelihood of human error in data entry, or even result in missed sales opportunities. Therefore, jewellers looking to grow and enhance their offering should consider how an integration solution that streamlines and centralises all of the above can help.

If that sounds like something you might be interested in, talk to us about our exclusive Pursuit integration solutions for Shopify, Woocommerce and Magento.

Fashion and apparel

The fashion and apparel industry has also been adversely affected by the COVID-19 pandemic. Fundamentally, those retailers who had implemented digital strategies before the pandemic hit have felt some, but not all of its impacts.

The digital-first business models such as those adopted by boohoo and Asos have enabled them to continue serving their customers online. On the other hand, companies such as Debenhams that had invested heavily in physical stores were adversely affected and had to close most of their stores. As a matter of fact, it’s just their online sales division that survived the pandemic.

Recent statistics from the ONS have revealed that online channels accounted for 50% of clothing and footwear sales in January 2021.

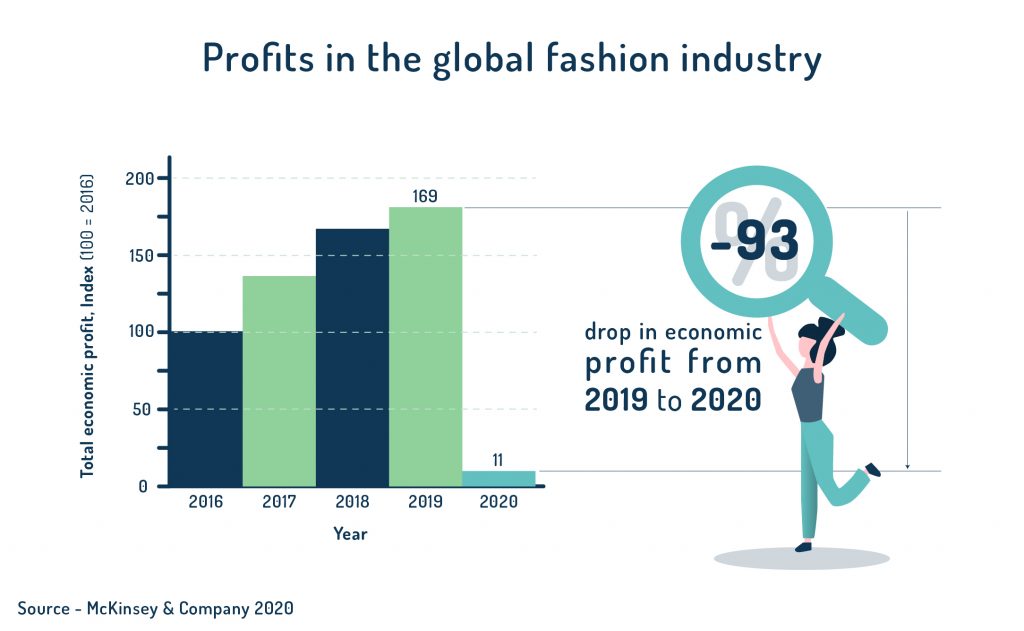

But much like the jewellery industry, changing consumer lifestyles and attitudes are a knock on effect of the pandemic that have impacted the overall sales of fashion and apparel goods. Globally, the industry’s profits are predicted to have dropped by 93% in 2020.

It isn’t all bad news for businesses operating in the area though. Clothing will continue to be a necessity for consumers, albeit their styles and needs will undoubtedly change over time. For instance, loungewear sales surged by almost 50% in 2020 due to lockdown restrictions, with e-commerce businesses such as Missguided seeing sales for casual items, including joggers and leggings, rise by 700%.

Success, therefore, is all down to a business’s ability to adapt and scale their offerings in line with changing consumer needs. And e-commerce offers a way for businesses to do just that. Online sales channels provide a unique data capture opportunity at the point of sale. For instance, as well as sales figures for particular products, online retailers can leverage page views and search volumes in order to determine the real-time needs and interests of their customers, and then use such information to inform better decisions about their offering.

These benefits alone form a strong case for businesses to develop their online channels in order to avoid similar challenges in the future.

Real estate and property

The COVID-19 pandemic presented unprecedented obstacles for the real estate industry. Notably, in the early months of the initial lockdown, new property transactions came to a halt as buyers were unable to physically view homes.

Similarly, work from home orders meant office and business space transactions were also left in limbo.

The real estate and property market has largely remained in the physical realm, with property listings and enquiry forms being as far as it went in terms of e-commerce and digitisation. And understandably so, as few will be comfortable with making such a significant purchase over the internet.

However, the increased level of risk in densely populated cities combined with greater uptake in remote working fuelled the demand for countryside homes. This caused house transactions to soared by 24.1% over the course of 2020.

Additionally, government initiatives to aid the economy’s recovery, including an extended Stamp Duty Land Tax holiday and the reintroduction of 95% mortgages have incentivised buying at this time.

Consequently, use of e-commerce channels in the real estate market are increasing in popularity and prominence, particularly when supplemented by other digital innovations such as virtual reality viewings and remote consultations. Under the current circumstances, these are proving the safest and in many cases, the only way to buy.

However, with the shift towards remote working, the outlook for commercial property transactions is much more uncertain.

Sport and fitness

National lockdowns and COVID-19 restrictions have posed challenges for the sport and fitness industry. While gyms and sporting venues have been forced to close, the e-commerce and online market is booming.

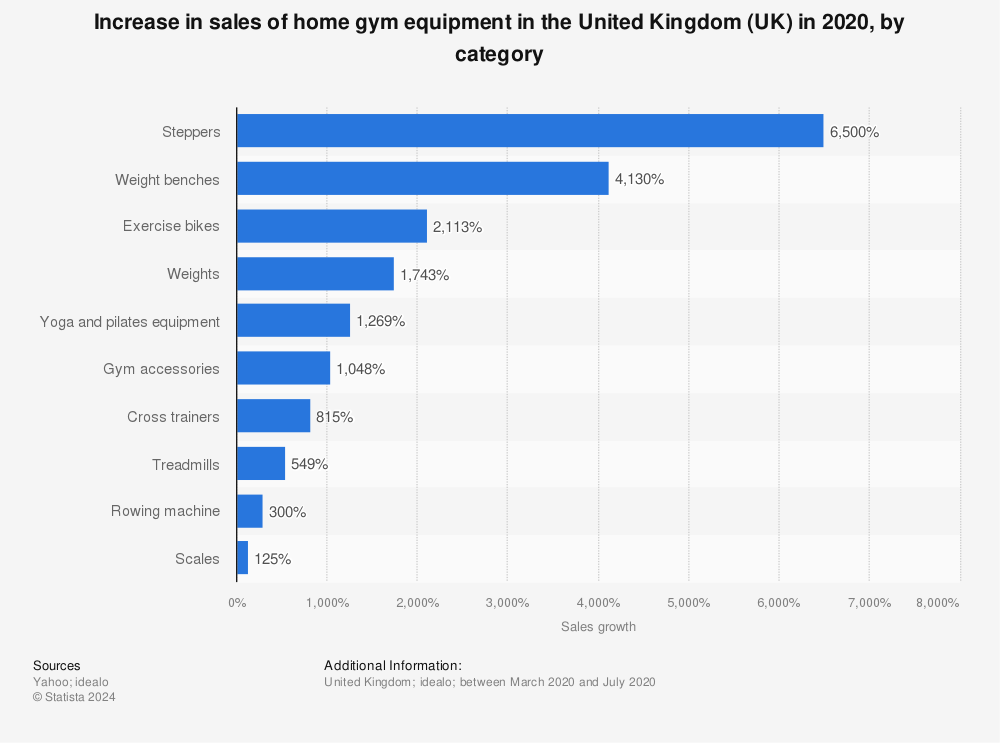

Sales figures for at-home gym equipment such as steppers, weights, and benches all saw increases, and exercise bike sales grew by 2,000% between March and July 2020.

Find more statistics at Statista

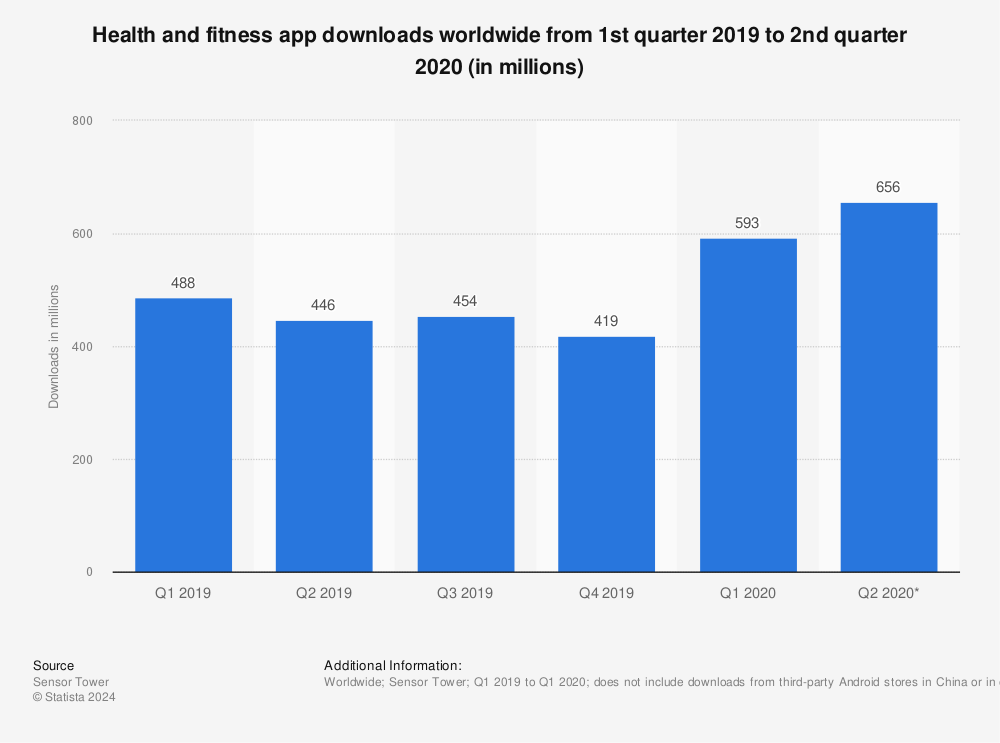

The industry saw a significant move towards digitisation in many other ways, too. For instance, fitness app download figures peaked in 2020, with an estimated 656 million downloads worldwide during the second quarter of the year.

Find more statistics at Statista

Similarly, the uptake in remote training sessions is clear evidence of a societal shift in both attitudes and behaviours as a result of the pandemic.

Restrictions have meant consumers have had more time on their hands to take up new hobbies and work towards health and fitness goals they have been too busy to pursue. For others, working out at home, or during the permitted daily hour outdoors, has been one of the only opportunities to take a break from a merged work and home life.

But regardless of the reason, there is clear evidence for a continued demand for the industry’s offerings. And although gyms and facilities may reopen, the new virtual fitness journeys many have embarked on should continue to be supported.

Technology and web

With an increasing number of businesses across all industries realising the importance of online presence during the COVID-19 pandemic, demand for technology and website services has remained strong.

But in the same breath, there have been equally as many businesses forced to temporarily close their doors, or scale back activity to offset any financial losses. Although new business and interest in services hasn’t declined, the amount these businesses are willing to spend has.

Therefore, the industry is expected to see an overall drop in revenue of 2.6%. However, there is confidence in the industry’s ability to bounce back as normalcy resumes.

Homeware and furniture

Before the pandemic, the homeware market was at its highest value. But like many other industries, it took a significant hit as store closures and supply chain delays began to occur.

And while this has impacted revenues and profits for many businesses, the stay at home restrictions prevented damage from being as substantial as it could have been. Market value for 2020 is at an estimated £11.7 billion, which is above its recorded value five years prior.

Despite some months of eased restrictions allowing stores to reopen, sales have largely occurred online. In fact, sales volumes peaked in December 2020 when they amounted to over £3.9 billion. While sales tend to be higher in the final month of the year due to the festive rush, last year was significantly different because of the rising virus risk and fresh lockdown restrictions. Consequently, many of these sales can be attributed to online channels.

Additionally, there have been a number of other trends in the industry that have contributed to its sustained performance. Working from home measures have driven a rise in home office furniture sales with John Lewis reporting significant increases in demand for items such as desks, chairs and desk lighting. Similarly, the increased amount of free time spent in the house has resulted in DIY, refurbishment and redecorating projects, all of which have required supplies from household goods stores.

Subscription based products and services

Subscription based services have gained popularity in recent years. This is largely due to more industries undergoing digital transformation, and driving usage of services such as music, TV and film streaming, which work on subscription based models.

While these services were already appealing to on-demand and digital savvy consumers, the pandemic has increased their popularity as they have provided a flexible way for people to access entertainment at home during the lockdown.

Consequently, businesses such as Netflix, Spotify and Disney Plus all enjoyed a successful year.

The pandemic has also driven a rise in subscription box products that can be ordered online and delivered directly to your door. Due to their popularity, there are now subscription box services for everything from food, wine and plants, to beauty products and shaving supplies.

And while many of these were around before the pandemic, the lockdown created the perfect circumstances for such services to thrive.

Consequently, a quarter of people in the UK are signed up to a subscription box service. The most popular being food, razors and shaving items, perfume and cosmetics, clothing and contact lenses.

For online retailers, subscription models are a proven way to encourage loyalty and increase the lifetime value of customers. The approach has proven such a success that over 70% of D2C brands have, or are planning to, include subscriptions in their e-commerce strategies.

The businesses that were able to capitalise on this shifting consumer behaviour were those that had effective e-commerce services in place. For instance, despite the closure of almost every physical store that stocks Hornby toys, the brand experienced a 33% rise in sales thanks to purchases made through its owned e-commerce channels and those of distributors.

Automotive

Prior to the pandemic, the automotive industry was already facing disruption with shifts in both consumer behaviours and government requirements. This has forced brands to rethink and re-strategise business models to take into account electric vehicles, the phasing out of diesel cars and the sharing economy.

COVID-19 arrived at a time when businesses were already shaken, causing more disruption and uncertainty. On top of the shifts that were already underway, the pandemic saw consumers’ need for cars drop dramatically due to stay at home orders and restricted travel. Consequently, new car sales fell by 30% during 2020.

However, the pandemic also caused some attitude changes that positively impacted the industry. For instance, with public transport halted or viewed as a higher risk and car sharing prohibited, more were inclined to buy their own vehicle. In a study conducted by Google, it was found that 12% of people who did not own a car were considering making a purchase following the onset of the pandemic.

Despite clear demand, many car dealerships existed solely in the physical world before COVID-19 restrictions were put in place. Online channels were largely used for lead generation and supporting customer research, with sales still depending on a dealership visit. But with 90% of customers conducting research online prior to making a purchase, and 19% stating they would have bought a car sooner during lockdown if an online option was available, dealers were clearly missing valuable opportunities.

Therefore, the automotive industry has undergone significant digitisation in order to continue satisfying demand from customers. Now, the full buying journey can take place online.

But as well as the option to buy online, e-commerce functionality must be supplemented by a number of other digitised services, including virtual viewings, online document signing, video consultations and click and collect or home delivery services.

Pet supplies

Pet acquisition rose significantly during the UK’s lockdown, with 5.7 million welcoming a new addition to the family, of which 2.1 million belonged to the millennial demographic. This was mainly because people were stuck at home with nothing to do.

Consequently, with a greater number of pet owners, there was a rise in pet care and supply sales, too. And although some pet shops were permitted to remain open as essential businesses, the main channel through which sales took place was online.

Therefore, with the rise in pet ownership, particularly among the younger, digitally-savvy consumer group, and the accelerated digitisation of businesses, e-commerce sales are predicted to face steady growth over the next five years.

Professional services

Each professional service has faced its own set of challenges during the pandemic. Although, in no case has demand stopped. For some, it has actually increased, which has created greater workload and burden for businesses who have been forced to scale down operations in order to contain the spread of the virus.

More than a fifth of firms (22.3%) anticipated greater workload and growing revenues by the end of 2020, while 27.7% admitted to making, or had made, tough staffing decisions.

The most significant change in the industry however, has been in its use of digital channels. Businesses have now moved away from websites and digital communications focused solely on lead generation, and instead, offer online services and solutions that would typically take place in office meeting rooms.

For instance, live chat functions, appointment booking forms, document signing and video consultations can now support clients remotely, opening up services to new businesses and locations without geographical constraints.

While the opportunities are clear, there is a challenge in ensuring the personable service many of these businesses have perfected in the physical world is translated via digital channels. Therefore, user experience is key in the design, development and implementation of any online offering.

Nonetheless, as more and more industries begin to reopen, the demand for professional services will likely remain strong. However, offers of remote services should continue in order to cater to digitally-adjusted clients.

Food and beverage

Each sector of the food and beverage industry has been impacted by the COVID-19 pandemic differently. The one similarity is the accelerated adoption of digital sales and communications channels.

Restaurants

Although restaurants have been forced to close for the majority of the pandemic’s duration, many businesses quickly introduced takeaway services as a means to claw back some revenue. And the easiest and most COVID-safe way to do this was to set up shop online.

Digitised menus, online ordering systems and payment gateways supported by contactless home delivery or curbside pick-up have enabled restaurants to continue conducting business, while ensuring both staff and customers are protected.

But as well as creating their own online sales channels, more restaurants have been joining marketplace facilitators such as Deliveroo and UberEats, in order to be seen by a greater number of customers and provide a trusted and convenient delivery solution.

Consequently, 11,000 new restaurants joined Deliveroo in 2020, and of these, 7,400 were small businesses. Similarly, UberEats recorded a rise of 224% for online orders in the final quarter of 2020.

The brief relaxation of COVID-19 restrictions over the summer also provided a glimpse into the future of the industry – and unsurprisingly, it is looking just as digitised as all other sectors. Notably, many venues had introduced a table service via online orders placed through an app or by scanning a QR code.

These measures were put in place to minimise human contact and prevent the spread of the virus. However, they are expected to continue once restrictions are eased because they offer a convenient way to place an order.

Supermarkets

Supermarkets have remained resilient despite market uncertainty, largely because they have been one of the only types of stores permitted to stay open due to their provision of essential items.

Despite fluctuations in demand, for instance at the onset of the pandemic when there was a rise in stockpiling behaviours, physical store visits have remained popular. For many, a weekly shopping trip for essential food and drink supplies has been a welcomed break from staying at home.

That said, online grocery shopping has become equally as popular and prominent, which is evident through the shortage of delivery slots. As a result, Ocado’s retail revenue grew by 35%, and various supermarkets saw success in ramping up partnerships with alternative online sales and delivery routes.

For instance, Morrisons saw online sales triple over the course of the pandemic as it joined forces with Amazon UK to supply Prime customers with a free, same day, express grocery delivery service.

Similarly, much like restaurants, local convenience stores are increasingly partnering with the likes of Deliveroo and UberEats too, in order to provide shoppers with easy access to essential items.

While these online ordering routes have typically been favoured by younger demographics in the past, during the pandemic, there has been a significant shift in the age of users. For instance, Waitrose have reported that the number of over 55’s using its online grocery shopping service has tripled during the pandemic.

But while this was due to the increased level of risk the virus posed for these individuals, it is apparent that eyes have been opened to the ease and convenience offered by the e-commerce channel. Therefore, among those that have formed new online habits over the past year, 42.6% will continue at the same level post-pandemic.

However, it is unlikely that in-store grocery shopping will slow any time soon, but retailers should be aware of the potential opportunities that exist online. The recent Christmas period, for example, saw online sales figures double from the previous year, creating a strong case for a shift in focus.

Final thoughts

Undeniably, the COVID-19 pandemic has caused widespread disruption in all industries. Although digital transformation was already underway, the challenges this disruption has caused has created an urgent need for businesses to accelerate plans and strategies in order to cater and respond to changes in both the market and consumer behaviours.

The businesses thriving during the lockdown are those that have been prompt at responding to the digital shift, as for the most part, many of their products and services have remained unchanged.

But while many of these businesses have been operating with digital-first models long before the pandemic, it would be wrong to assume opportunity is lost for those that have taken such an approach in more recent times. In fact, with strong evidence to suggest consumption habits will remain digital once the pandemic has run its course, online focus is key for the future success and sustainability of all businesses.

Furthermore, while businesses have been doing all they can to operate effectively during this time, and consumer sentiments have, understandably, been knocked, the confidence of both business owners and customers in online offerings has greatly improved.

This is yet another case for the continued focus and development of e-commerce and digital channels, as not only will they adhere to the wider shift, but will also improve convenience, efficiency and accessibility for all parties.

For more information regarding e-commerce or digitising your business, please get in touch with our expert team.

Post navigation

Read More Blogs

Understanding Gmail and Yahoo’s 2024 Inbox Updates

As we usher into the new year, Gmail and Yahoo are tightening the screws on

Magento upgrade: the best practice to ensure a safe implementation

Discover how to safely upgrade Magento with the best practices, from backing up